With the rapid development of AI technology, specifically ChatGPT. Have you ever thought that the ChatGPT will ever replace actuaries?

While it’s true that AI has made significant strides in various industries, including insurance and finance, it’s important to fully understand the positive and negative impact of ChatGPT on actuaries. So, let’s dive in and explore this topic together!

Will ChatGPT Replace Actuaries?

While there has been much speculation about the potential for AI to replace actuaries, it is unlikely that ChatGPT or any other AI technology will replace actuaries in the near future.

Actuaries possess a unique set of skills and expertise that AI cannot replicate. While ChatGPT can augment the work of actuaries, it is not yet able to fully replicate the complexity of human thought and decision-making.

Actuaries not only have the technical expertise to analyze data and calculate risks, but they also have a deep understanding of the industry and its trends. They can take into account factors such as changing economic conditions, emerging technologies, and regulatory changes.

While ChatGPT has made great strides in areas such as fraud detection and claims processing, there are still limitations to what it can do. AI can analyze vast amounts of data and make predictions based on that data but lacks the human insight and experience that actuaries bring to the table.

ChatGPT is still in the early stages of development and is not yet able to fully replicate the complexity of human thought and decision-making. While it can perform certain tasks more efficiently than humans, it is unlikely to fully replace the role of actuaries in the near future.

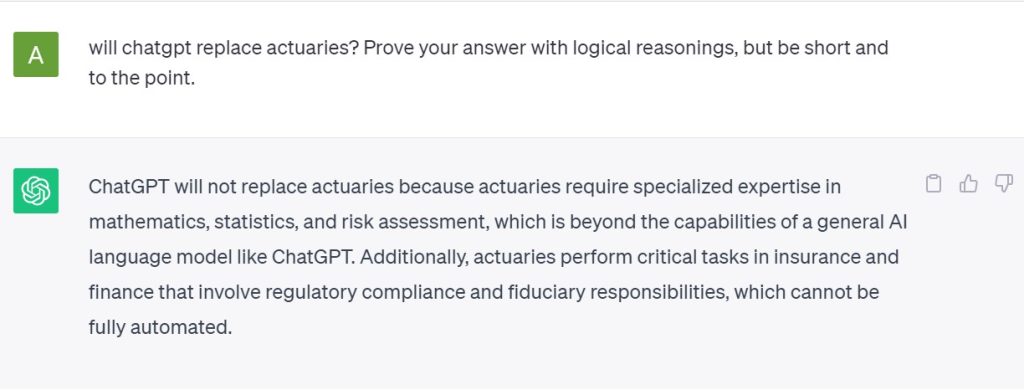

Let’s ask the same from ChatGPT and look how it responded:

How will ChatGPT Impact the Future of Actuarial Work?

ChatGPT and other AI technologies are likely to have both positive and negative impacts on the future of actuarial work. Let’s explore some of these impacts in more detail:

Positive Impacts

Every technological advancement has its pros and cons, which ultimately effect the course of action. Let’s discuss some of the positive impacts of the ChatGPT on the actuarial work.

Increased Efficiency

One of the main benefits of ChatGPT is its ability to process vast amounts of data quickly and accurately. This means that actuaries can spend less time on data entry and more time on analysis and interpretation, which can lead to more informed decision-making.

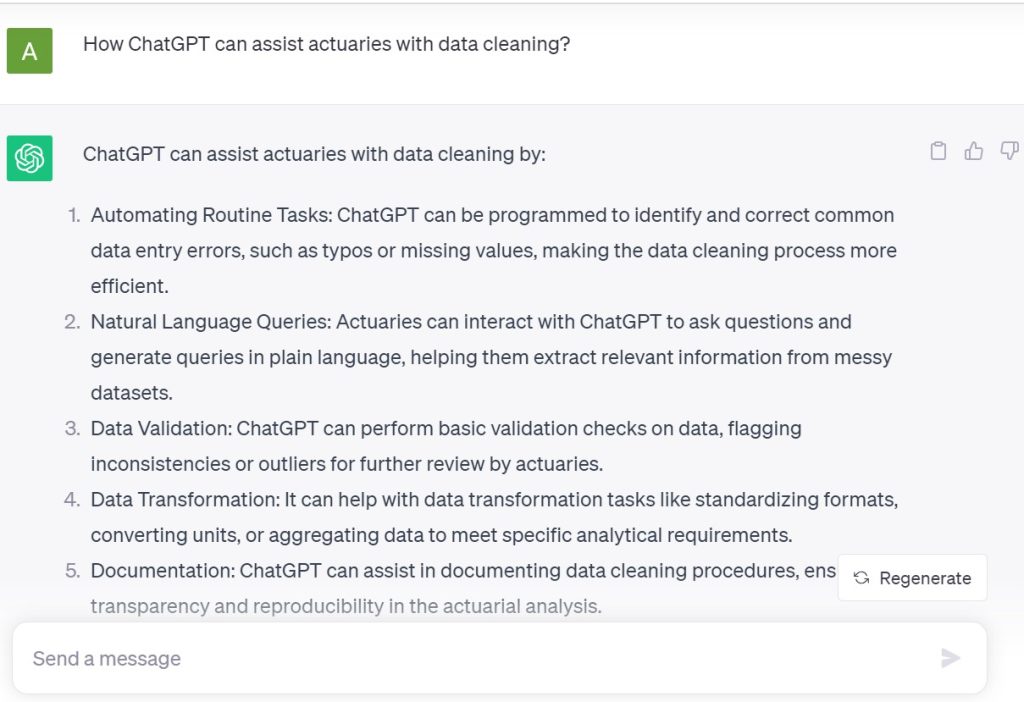

For example, ChatGPT can assist actuaries with data cleaning, which is a time-consuming and tedious task. Let’s see how ChatGPT can do this:

By automating this process, actuaries can focus on more value-added tasks such as analyzing trends and making predictions.

Improved Accuracy

ChatGPT can help actuaries to make more accurate predictions and informed decisions. By analyzing large amounts of data and identifying patterns and trends, ChatGPT can provide valuable insights that may be missed by human analysts.

For instance, ChatGPT can analyze data from a variety of sources and predict which policyholders are most likely to make a claim, enabling insurers to take proactive measures to prevent those claims from occurring.

Enhanced Customer Experience

ChatGPT can also be used to improve the customer experience by providing personalized recommendations and guidance. By analyzing customer data, ChatGPT can identify trends and preferences, and provide customers with tailored advice and recommendations.

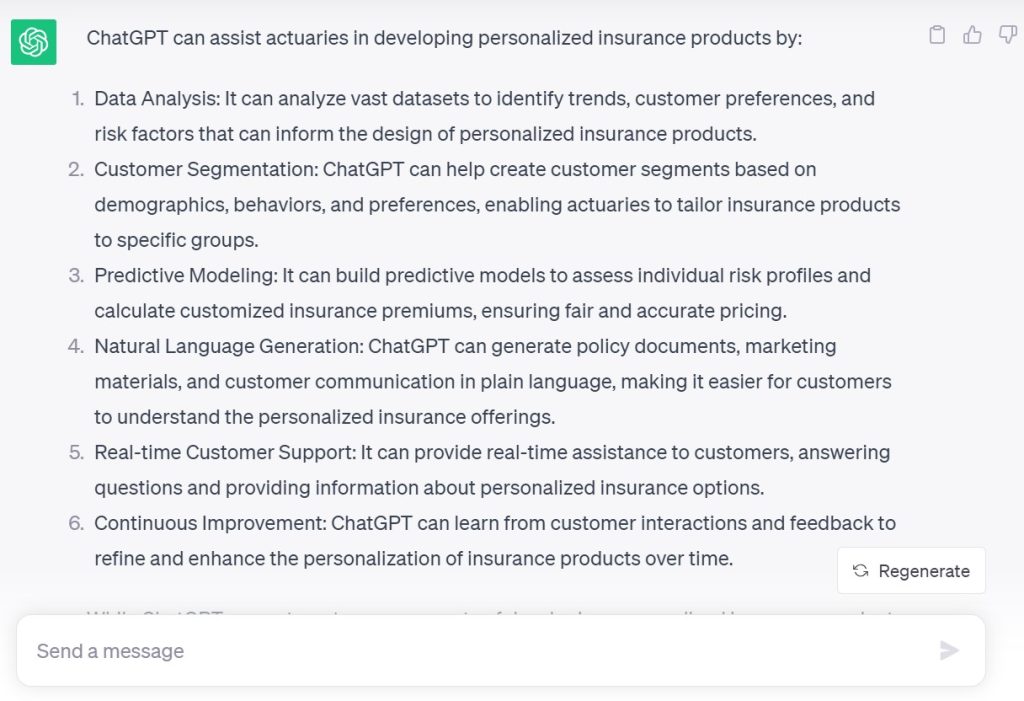

For example, ChatGPT can assist actuaries in developing personalized insurance products that meet the specific needs and preferences of individual customers. We asked ChatGPT, how will you assist ChatGPT to develop personalized insurance products:

Negative Impacts

Until now, we have covered only the positive impact of ChatGPT on actuarial work. However, there are a few cons of ChatGPT on actuarial work, which we need to identify and keep an eye on them to properly embed ChatGPT for actuarial work.

Job Displacement

One of the biggest concerns about ChatGPT and other AI technologies is the potential for job displacement. While it is unlikely that ChatGPT will replace actuaries completely, it may lead to a reduction in the number of actuaries required.

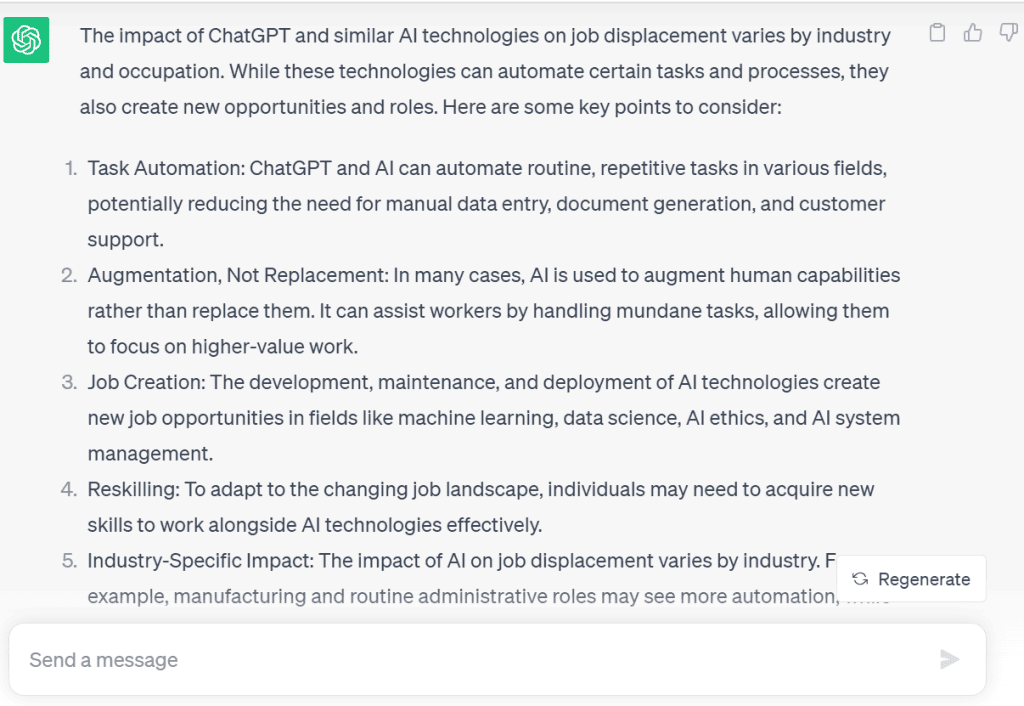

For instance, ChatGPT can automate certain tasks, such as data entry and cleaning, reducing the need for human actuaries to perform these tasks. This could result in a reduction in the number of entry-level actuarial jobs available. Let’s see how ChatGPT contirbutes towards job displacement (remember this is not true 100% but has some impact):

Bias

ChatGPT is only as unbiased as the data it is trained on. If the training data contains biases, then ChatGPT is likely to produce biased results.

For example, if ChatGPT is trained on historical data that contains biases against certain demographics, then it may produce biased results when making predictions about those demographics.

Why ChatGPT Cannot Replace Actuaries?

ChatGPT is an impressive AI technology that has the potential to revolutionize many industries, including actuarial work. However, there are several reasons why ChatGPT and other AI technologies cannot replace actuaries. Here are some of the key reasons:

ChatGPT Lacks Human Judgment and Experience

While AI technologies like ChatGPT can analyze vast amounts of data quickly and accurately, they cannot replicate the nuanced and complex decision-making processes that actuaries engage in.

Actuaries must consider a wide range of factors when making decisions, including historical data, emerging trends, regulatory environments, and human behavior. These factors require the application of human judgment and experience, which AI is not capable of providing.

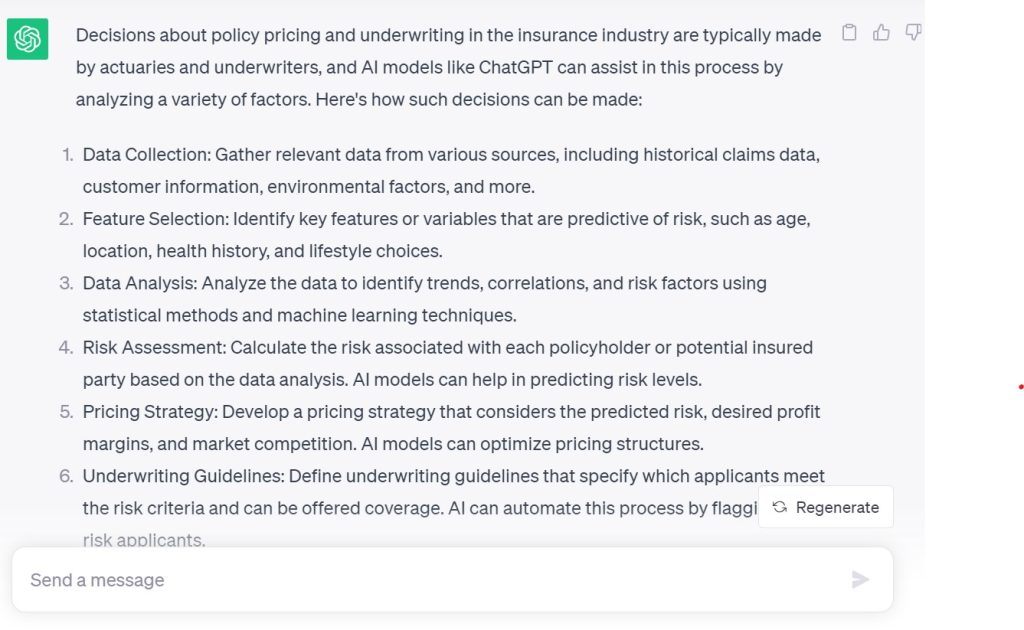

For example, an actuary working in the insurance industry may need to make decisions about policy pricing and underwriting based on a variety of factors, including demographics, health trends, and emerging technologies.

While ChatGPT can provide valuable insights into these factors, it cannot replicate the experience and expertise of an actuary in making these decisions.

Actuaries Bring a Unique Set of Skills and Expertise

Actuaries bring a unique set of skills and expertise to the table that AI cannot fully replicate. Actuaries are trained not only in data analysis and modeling but also in risk management, finance, and business strategy.

For example, an actuary working in the insurance industry must be able to interpret complex data, communicate findings to stakeholders, and make strategic decisions based on analysis. These skills require human judgment, experience, and creativity, which AI cannot replicate.

ChatGPT Is Limited By the Quality of its Data

Another limitation of ChatGPT is that it is only as good as the data it is trained on. If the training data contains biases or errors, then the AI will produce biased or erroneous results.

For example, if ChatGPT is trained on historical data that is biased against certain demographics or populations, then it will produce biased results when making predictions about those populations.

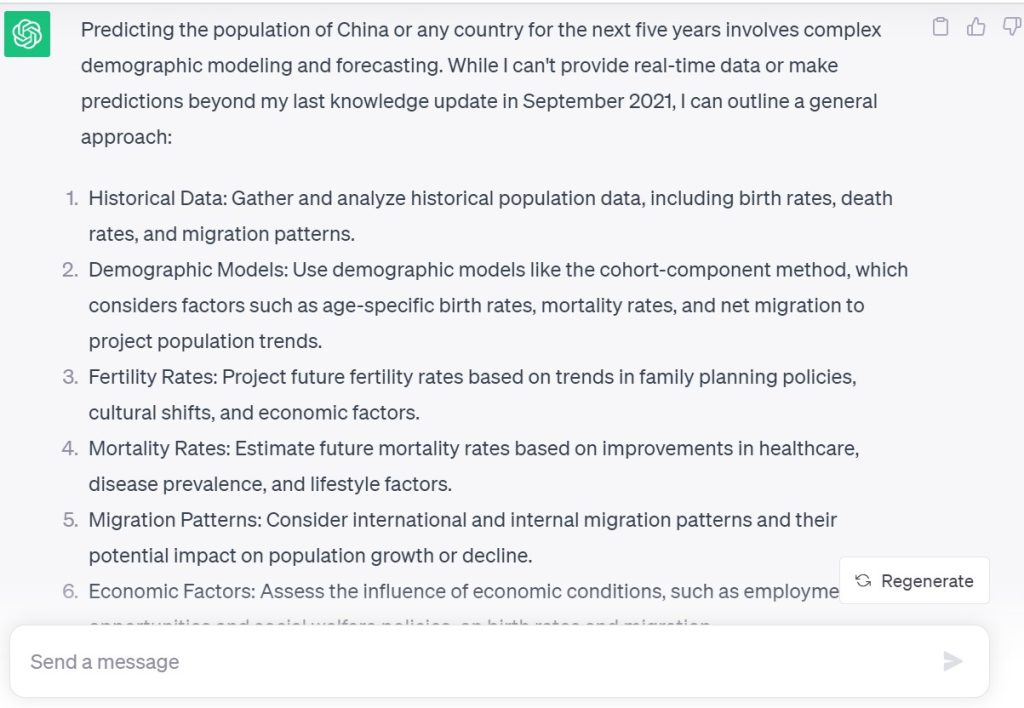

This can have serious consequences in actuarial work, where accuracy and fairness are critical. As an example, we asked ChatGPT to predict the population of the specific country and look how it answered:

ChatGPT Cannot Replace the Human Touch

It’s worth noting that ChatGPT cannot replace the human touch that is often necessary for actuarial work.

While AI can provide valuable insights and recommendations, it cannot replicate the interpersonal skills that are often required to build relationships with stakeholders, negotiate contracts, and make decisions that have an impact on people’s lives.

How Can Actuaries Use ChatGPT for Better Productivity and Results?

Actuaries have a lot to gain from incorporating ChatGPT into their work process. Here are some ways that actuaries can leverage this technology for better productivity and results:

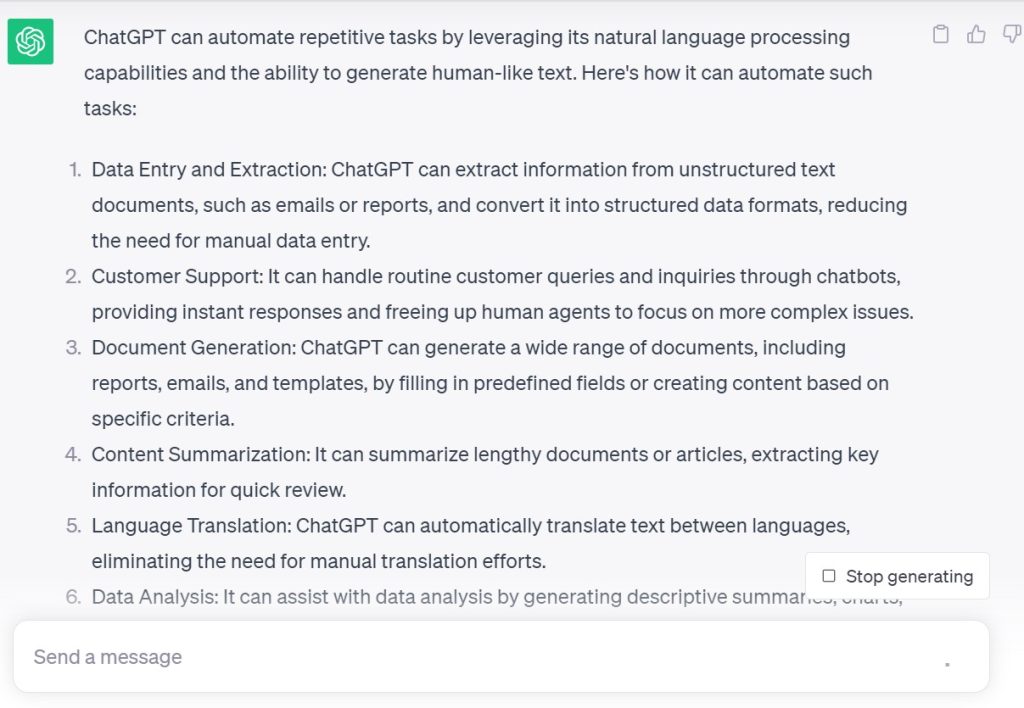

Automating Repetitive Tasks

ChatGPT can be used to automate repetitive tasks such as data entry, data cleaning, and simple calculations. By delegating these tasks to ChatGPT, actuaries can focus on more complex and strategic work. Let’s see how ChatGPT can automate repetitive tasks:

Generating Reports and Dashboards

Actuaries can use ChatGPT to generate reports and dashboards that summarize complex data and make it easier to understand. This can be particularly useful when presenting data to non-technical stakeholders who may not have a deep understanding of actuarial concepts.

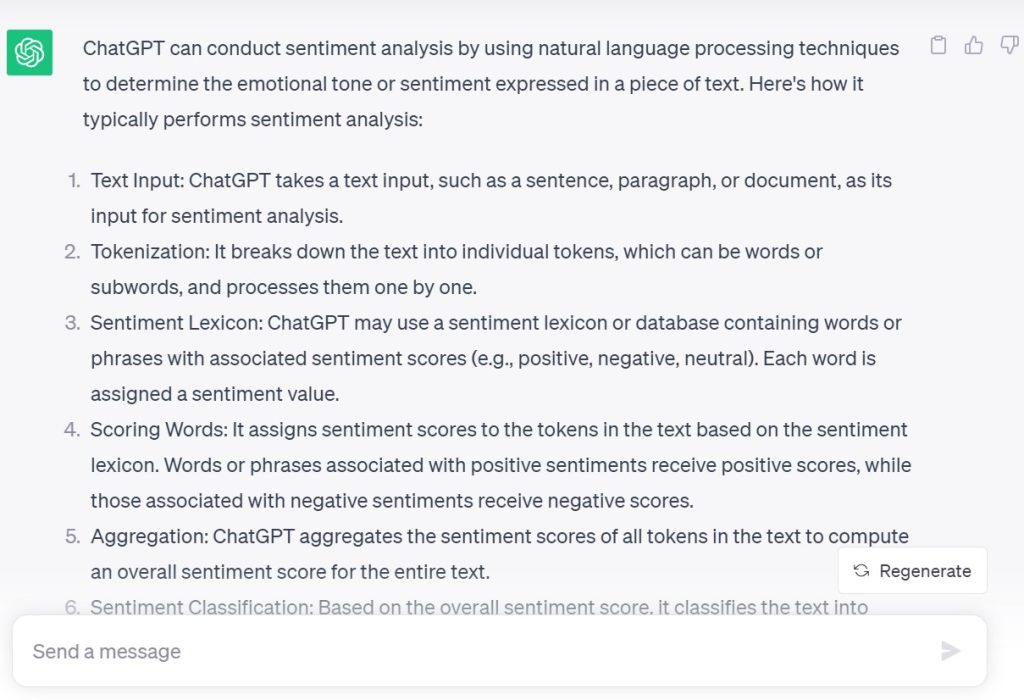

Conducting Sentiment Analysis

ChatGPT can be trained to analyze customer feedback and conduct sentiment analysis. This can help actuaries better understand customer behavior and preferences, which can inform product development and pricing decisions. Let’s ask ChatGPT how a sentiment analysis is conducted:

Improving Accuracy of Forecasts

ChatGPT can help improve the accuracy of forecasts by incorporating data from a wide range of sources and applying machine learning algorithms to identify patterns and trends. Actuaries can use this data to make more informed decisions about future trends and risks.

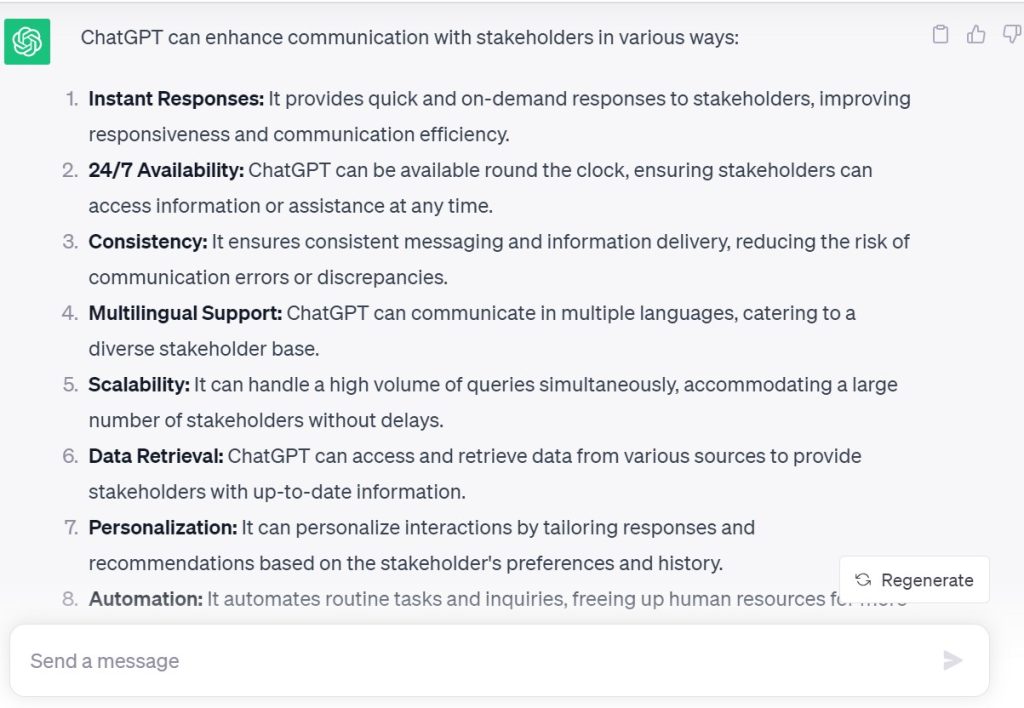

Enhancing Communication With Stakeholders

Actuaries can use ChatGPT to enhance communication with stakeholders by creating chatbots that can answer common questions and provide information on demand. This can improve the efficiency of communication and reduce the burden on the actuary to respond to queries. Let’s ask ChatGPT how it enhances the communication with stakeholders:

ChatGPT & Actuaries FAQs

Can ChatGPT Pass an Actuarial Exam?

ChatGPT cannot pass an actuarial exam because it is a language model trained to process and generate human-like language based on statistical patterns in text.

Although it can provide some assistance in studying, it does not have a deep understanding of the complex concepts and principles tested in the exams.

Can ChatGPT Help Actuarial Students Study?

ChatGPT can help actuarial students study by providing resources such as practice problems, exam tips, and study materials. It can process and generate large amounts of text and provide helpful information to students studying for actuarial exams.

Is There a Future for Actuaries?

There is a future for actuaries because their expertise in risk management, insurance, and financial planning is still valuable in today’s world. As industries continue to evolve, actuaries will need to adapt to new challenges and technologies to remain relevant.

Will AI Replace Actuary?

AI will not replace actuaries completely, but it will change the role of actuaries by automating certain tasks such as data processing, analysis, and modeling.

This will require actuaries to develop new skills such as data science, machine learning, and artificial intelligence to work effectively with AI systems.

Can ChatGPT Replace an Actuary?

ChatGPT cannot replace an actuary because it lacks the human judgment and expertise required to make strategic decisions based on complex data and risk analysis.

Actuaries possess deep knowledge and experience in their fields that are essential to making critical decisions that affect the financial health and success of organizations.

Can ChatGPT Replace Insurance Agents?

ChatGPT cannot replace insurance agents because it cannot provide the personalized advice and relationship building that is essential to the insurance industry. Insurance agents develop trust and rapport with their clients over time, building relationships that require human interaction and emotional intelligence.

ChatGPT lacks the social skills and emotional intelligence needed to provide the level of service and support that insurance agents offer their clients.